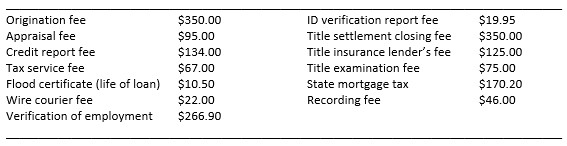

Some costs, as a consumer, feel like highway robbery. We reviewed a copy of a Home Equity Loan quote recently for one of our clients, through an “unnamed” local bank.

For a total of ………. $1728.45.

That was the cost of accessing the equity in their home. Banks must be doing pretty well. In fact, I asked ChatGPT to put together a list of every bank or credit union within a three-mile radius of the Financialoscopy® office. There were 13!

Is there an easier way to access safe money without all of these potential fees? Yup. You could borrow against the equity in your whole life insurance policy held at a mutual life insurance company. No fees. Yes, there is interest charged, but it’s set by the contract of your insurance policy.

What would you rather do – borrow against the equity of your whole life insurance policy and only have to deal with the principal and interest payments of a collateralized loan or have to navigate the potential fees of a bank or credit union?

If you would like to learn more about the other options available to you, then perhaps it’s time to schedule your Financialoscopy®.

Every financial institution has its own unique assortment of HELOC costs, which include fees and other charges. Contact your lending institution for the costs associated with any loan that you may request. Costs discussed during this presentation were provided to our firm during a recent interaction with a client who shared the breakdown of costs provided to them through their financial institution. Your costs may be different.