What does it mean to be a millionaire?

If you aspire to reach a million dollars or more in assets, it’s important to understand that it won’t necessarily provide what you may consider a “millionaire's lifestyle”.

The chart below shows the daily 10-year treasury yield going back over 60 years. This is considered to be the most liquid and widely traded bond in the world, because of its backing of the United States government.

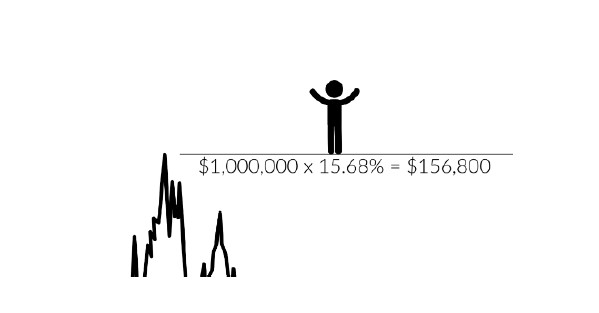

If you take a closer look (below), you can see that in the fall of 1981, the 10-year treasury provided a millionaire with a safe return of over $150,000 annually.

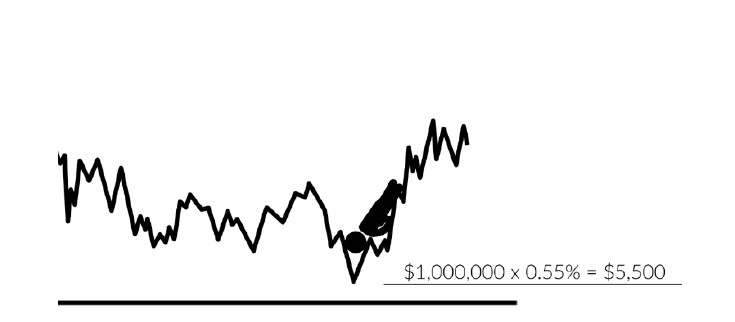

If we fast forward to the summer of 2020, that very same bond fell and would have provided a millionaire with a return of only $5,500.

It’s not about having a million dollars, it's about what a million dollars can produce. It’s about cashflow: a steady, predictable cashflow that may be able to weather possible wide swings of interest rates, markets, and inflation, which all affect your cashflow, i.e., the money you want or need to live on.

So, as you think about the future, maybe focus a little less on assets and focus a little more on creating predictable, spendable cashflow. That way, you can come out on top in retirement!

(Graph from: https://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart)